Have you ever wondered how to save tons of $$$ on your next travel adventure or if it’s possible to travel for free/nearly free? If you’ve questioned how to travel cheaply, maximize your budget or travel for free see below for tips & tricks you can utilize now that will help make your travel dreams a reality!

One of the simplest hacks that clever travelers in the know use while planning their adventures is to utilize credit card rewards points. This one simple trick can save every traveler hundreds or thousands of dollars on every trip you take! Points can be aquired via credit card sign up rewards & bonuses or earned through regular spending on a high point earning credit card with a dollar for dollar point matching plan and stored up for use later. Redeeming points for travel is usually the best option to stretch those points to their max and receive the biggest savings. Traveling with points is one of the easiest ways to save yourself hundreds if not thousands of dollars on every trip that you take. The best way to accumulate the points you’ll need for travel is by compiling large amounts of them through sign on bonuses. Another option is to use 1 card to put all of your monthly expenses on instead of paying for things with a debit card or cash (then making sure to pay off the total spent at the end of each month). This is an easy and quick way to rack up a ton of points each month! Points may also be gained by referring others to apply for one of the credit cards with a large referral reward, such as Chase Saphire or Chase Freedom credit cards. Capitol One Venture card usually has a great offer for refferals as well.

We have gained more than 300,00+ points over the past 2 years by referring other family members, friends and even each other (where we individually hold seperate personal accounts with the same credit card (this is often referred to as being a P2 credit card holder)). This way we’re able to double up on sign on offers and accumulate thousands of points rapidly after we meet the minimum spent requirements. Something to consider if one or both you and your spouse/partner have a buisness is to apply for a business credit card with a large sign on bonus. That could be the ticket to another 60-100,000+ points with just one card!

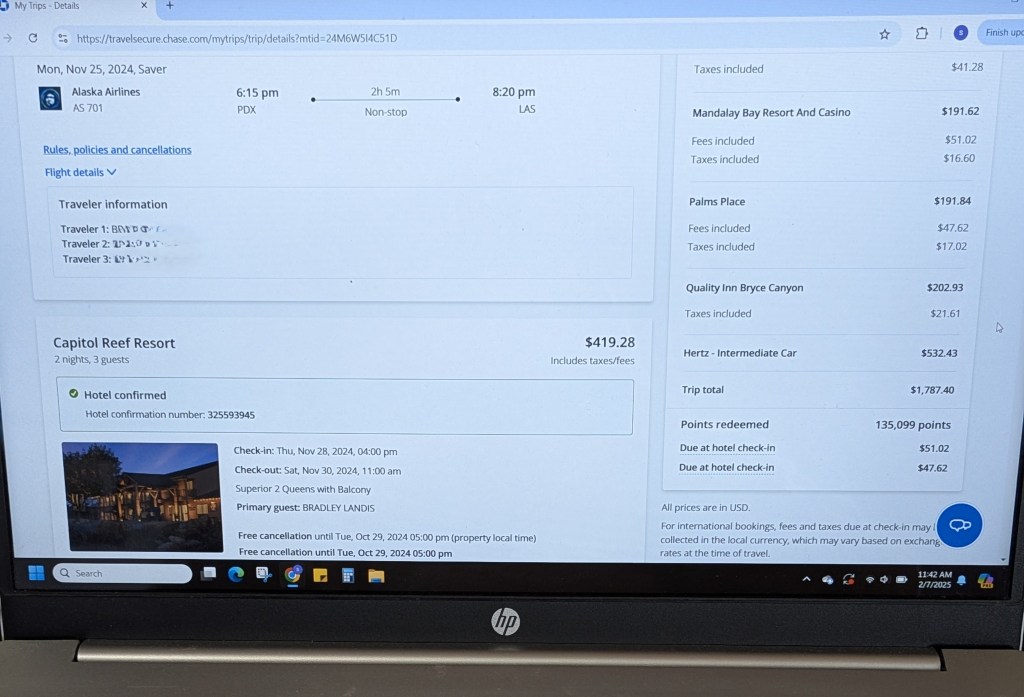

Our average monthly spending earns us an additional 36,000-48,000 points annually. Just by making the purchases we normally make every month. Combined with other points on our personal cards we’re able to stockpile them to help us save thousands when we book a large trip, cash them in for free stays at 5 star hotels, free flights, free rental cars & free experiences any time we’d like! With the amount of points we’ve earned over the past several years we’ve utilized our points to travel completely free mulitple times in the past 2 years: from Oregon to Washington DC & Pennsylvania *with rountrip trip flights for 3, 6 days rental car: an SUV from Hertz, and hotel stays all covered by points! We’ve also flown from Oregon to Las Vegas round trip, had an SUV from Hertz for 9 days, and spent 9 nights at various hotels (most were 4 & 5 stars!). **See photo below for the total points needed for our 9 night trip to the Southwest. On our last trip to Seattle we were able to book a last minute trip over NYE to stay book a suite in a 5 star hotel in the middle of downtown completely FREE!! It’s always amazing to me how much we’re able to travel for free because all the main expenses are covered by points!

If this sounds intriguing, the best way to hop on the points train is to look into credit card offers that you’re eligible or already pre-qualified for. Once you figure that out you’ll be able to sort through the offers to find the ones that will provide the highest amount of rewards points as their sign on bonus. Make sure to read all the fine print, document all the requirements, minimum spend needed to qualify for the rewards & the time frame that you must meet them in order to complete it successfully. One of the best cards we’ve personally enjoyed using is our Chase Saphire Preferred which earns high travel rewards with each purchase & offers an amazing bonus of 60,000 points for new cardholders. We also have benefitted from the Chase Freedom card & Chase Unlimited and the Southwest Rapid Rewards cards. You can learn more & apply up for them here:

It really is quite simple to collect points and grow them to a sizeable amount in a short amount of time. We have been racking up our points for the past several years and plan to cash them in for a large trip later this year. With the amount of points we have collected and saved we should be able to cover the entire cost of our trip prior to departure (flights, hotel, rental car, experiences) and only have the cost of food & gas/train tickets after we arrive as our expenses. It is so freeing to know that we’re able to travel anytime & anyplace we’d like and to do it for free is so rewarding.

After you arrive at your destination I recommend heading to a local grocery store and picking up the essentials, snacks & perhaps a few items to make a couple simple meals and anything else that you may have forgotten or will need for the duration of your trip. Doing this simple thing will save you hundreds on food costs over the course of your travels. We always buy breakfast items, simple snacks full of protein, several fruits and veggies and some lite meal options. I like to keep them easily accessible and within arms reach so we always have something to munch on whenever hunger strikes. Another way to save is to bring snacks with you in your carry-on/personal item or to stash a handful or two of snacks in your luggage. Doing this has saved us hundreds on each trip, plus it guarantees I’ll have a few snacks on hand if we run into a situation where we’re far away from food sources at a meal time. We also stock up on water bottles or 2 liter bottles so we can fill our refillable water bottles we always bring in our carry on luggage when we travel. This alone saves us so much $$, because we carry our water with us instead of paying for overly priced water during tours or while we’re out exploring.

Other simple tricks to keep your costs low are to research the differences in cost between local transportation options such as bus, train, metro, uber, taxi, lyft etc and the cost of renting a car & paying for gas. If you choose the latter remember that you’ll most likely be able to cover the total of your rental car fees with credit card points so the only expense you’ll need to worry about is gas. For that I suggest downloading a gas saving app such like GasBuddy can help you save on gas costs and there are several apps that will allow you to track spending and several will give you cash back for snapping photos of your receipts (*such as Fetch, Ibotta & Rakuten). Another really great app that will help you find activities and experiences for less $ is: https://yazing.com/

Where would you go if you could get there for FREE? Tell me in the comments & ask any questions you might have about travel with points. I’ll do my best to answer them 🙂

Until next time, happy adventuring everyone!

~Krista

All rights reserved @stampsinmypassport.com copywright 2025

Leave a comment